At its core, an S Corporation is a special type of corporation that meets specific IRS requirements.

These requirements allow it to be taxed under Subchapter S of the Internal Revenue Code.

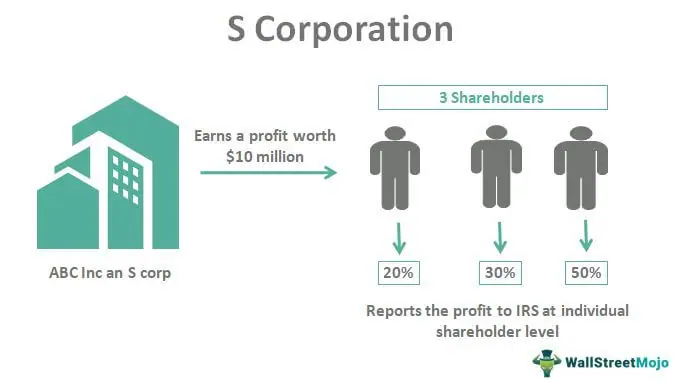

This means an S Corporation is generally not subject to federal income tax.

Instead, income, losses, deductions, and credits pass through to the shareholders’ tax returns.

This is known as “pass-through taxation.”

In simpler terms, an S Corporations lets you enjoy the benefits of a corporation while avoiding the double taxation often associated with traditional C Corporations.

The Benefits of an S Corporation

Understanding the benefits of an S Corporations can help you make informed decisions.

Let’s break down the primary advantages.

Pass-Through Taxation

One of the most significant benefits of an S Corporations is pass-through taxation.

With this structure, the company itself does not pay income tax.

Instead, the profits and losses are reported on the shareholders’ individual tax returns.

This can result in significant tax savings.

For example, if your S Corporations makes $100,000 in profit, that income is passed to you and your shareholders.

You’ll only pay taxes on that income at your tax rate, avoiding the double taxation C Corporations face.

Limited Liability Protection

An S Corporation provides limited liability protection to its shareholders.

This means that personal assets are generally protected from business debts and liabilities.

For instance, if your S Corporation faces a lawsuit or incurs debt, creditors typically cannot go after your assets.

This protection is one of the main reasons many entrepreneurs choose to incorporate.

Credibility

Having an S Corporation can lend credibility to your business.

When clients or partners see that you operate as an S Corporation, they may perceive your business as more legitimate and trustworthy.

This can help you attract new customers and establish partnerships.

The Process of Setting Up an S Corporation

Now that you know what an S Corporation is and its benefits, let’s consider how to set one up.

Step 1: Choose a Business Name

Your first step is to choose a unique business name.

Make sure it complies with your state’s rules for business names.

Most importantly, the name should be memorable and reflect your brand.

Step 2: File Articles of Incorporation

Next, you’ll need to file Articles of Incorporation with your state.

This document typically includes basic information about your business, such as its name, address, and the number of shares it can issue.

Step 3: Obtain an Employer Identification Number (EIN)

An EIN is necessary for tax purposes and is often required to open a business bank account.

You can obtain an EIN through the IRS website, which is straightforward.

Step 4: Create Corporate Bylaws

Corporate bylaws outline how your S Corporation will operate.

This includes details on how meetings will be conducted, how decisions will be made, and how profits will be distributed.

Having clear bylaws helps establish a solid foundation for your business.

Step 5: File Form 2553 with the IRS

You must file Form 2553 with the IRS to elect S Corporation status.

This form lets you notify the IRS of your election to be taxed as an S Corporations.

Be sure to file this form within the required time frame to avoid delays.

Eligibility Requirements for an S Corporation

While S Corporations offer many benefits, not all businesses qualify.

Here are the primary eligibility requirements:

Number of Shareholders

An S Corporations can have up to 100 shareholders.

This limitation helps maintain the structure’s simplicity.

Shareholder Residency

All shareholders must be U.S. citizens or resident aliens.

This requirement ensures that the tax benefits apply to individuals subject to U.S. tax laws.

Single Class of Stock

An S Corporations can only issue one class of stock, although differences in voting rights are allowed.

This keeps the structure straightforward and manageable.

Real-Life Example: The Impact of Choosing an S Corporation

Let’s examine a real-life example to illustrate how an S Corporation can benefit a small business owner.

Meet Sarah, who runs a thriving consulting firm.

Initially, she operated as a sole proprietor, but she formed an S Corporation as her business grew.

After making the switch, Sarah noticed several benefits.

First, her tax situation improved significantly.

By electing S Corporation status, Sarah could pass through profits to her tax return, avoiding the double taxation faced by C Corporations.

This resulted in substantial tax savings that she reinvested into her business.

Additionally, the limited liability protection provided her peace of mind.

When a client filed a lawsuit against her business, Sarah was relieved to know her assets were protected.

Sarah also found that having an S Corporation boosted her credibility.

Potential clients felt more confident partnering with a formally incorporated business, which led to increased revenue and new opportunities.

Common Misconceptions About S Corporations

Despite the benefits, some things need to be clarified about S Corporations.

Let’s clear up a few of them.

S Corporations are Only for Small Businesses

While S Corporations are often associated with small businesses, that’s not always the case.

As long as you meet the eligibility requirements, any qualifying business can elect S Corporation status.

S Corporations Don’t Have to Pay Taxes

It’s a common myth that S Corporations never pay taxes.

While they avoid federal income tax at the corporate level, they may still be subject to other taxes, such as state or payroll taxes.

Shareholders Can’t Take a Salary

Another misconception is that shareholders cannot take a salary.

Shareholders who actively work in the business must pay themselves a reasonable salary subject to payroll taxes.

Conclusion: Is an S Corporation Right for You?

Forming an S Corporation can provide numerous benefits for many business owners.

From pass-through taxation to limited liability protection, S Corporations offer a unique blend of advantages that can enhance your business.

However, it’s essential to consider your specific situation and business goals.

If you have questions, consulting with a tax professional or business advisor can help determine if an S Corporation is the right choice.

Remember, the journey to entrepreneurship is unique for everyone.

With the right structure, you can focus on what you do best: growing your business and serving your customers.

Comments are closed