Starting a business can feel overwhelming.

However, when it comes to simplicity, business structures are more complex than those of a sole proprietorship.

If you’ve ever thought about being your boss or turning a side hustle into something more, the sole proprietorships is often the first step.

It’s the most common business type for new entrepreneurs, and for good reason.

It’s easy to set up, inexpensive, and gives you full control over your business decisions.

But what exactly is a sole proprietorships, and how can it benefit you?

Let’s break it down.

What Is a Sole Proprietorship?

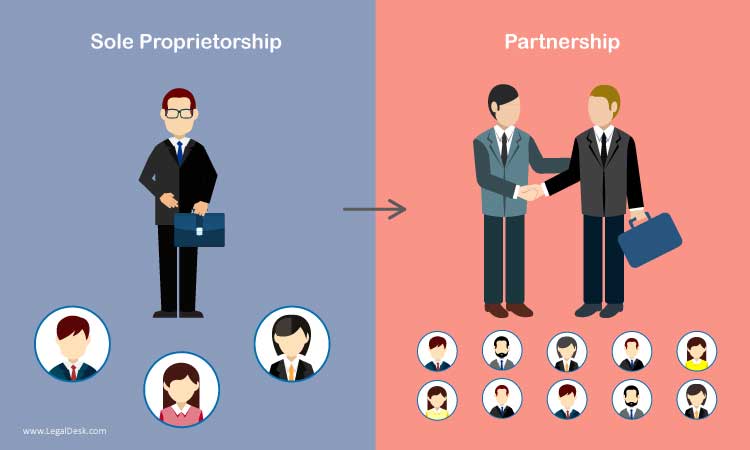

A sole proprietorship is the simplest form of business ownership.

There is no legal distinction between you as the business owner and the business itself.

You’re responsible for everything—both the successes and the risks.

As a sole proprietor, you get to keep all the profits, but you’re also personally responsible for any debts and liabilities the business might incur.

This key characteristic sets a sole proprietorships apart from other business structures like LLCs or corporations.

Real-Life Example: From Side Hustle to Sole Proprietorship Success

Let’s consider the story of Sarah, a graphic designer who started freelancing while working her 9-to-5 job.

She wanted to avoid dealing didn’t with complicated paperwork, so she ran her freelance business as a sole proprietorships.

There were no complicated legal hoops to jump through—she started offering her services and reported her earnings on her tax return.

Over time, Sarah’s client list grew, and her side hustle became a full-time gig.

Her sole proprietorships allowed her to transition smoothly from employee to business owner without the burden of complex legal structures.

Her ability to manage all aspects of the business, from marketing to client relations, was made easier by the flexibility of a sole proprietorship.

Why Choose a Sole Proprietorship?

When starting, many entrepreneurs choose a sole proprietorship because of its simplicity and low cost.

Unlike corporations or LLCs, a sole proprietorships doesn’t require formal registration (though some states or localities might ask you to get a business license).

There are fewer ongoing compliance requirements, and you won’t need to file separate business tax returns.

Everything flows through your tax return.

This makes managing taxes much more straightforward than it would be for a larger, more complex business structure.

For example, in a sole proprietorship, your income is taxed as personal income, and you report your business earnings and expenses on a Schedule C form attached to your tax return.

There’s no need for a separate corporate tax filing, which can save time and money during tax season.

The Flexibility of a Sole Proprietorship

Another big draw of the sole proprietorship is its flexibility.

You can start and stop your business without jumping through bureaucratic hoops.

You can easily transition if you decide that business ownership isn’t for you or want to switch to a different structure later.

Take John, for example, who started his carpentry business as a sole proprietor.

For years, John enjoyed the freedom to take on as many or as few projects as he wanted.

When his business grew to the point where he needed to hire employees and take on bigger contracts, he transitioned his business into an LLC for more legal protection.

However, because he started as a sole proprietorship, John could launch his business with minimal hassle, build it up over time, and switch structures only when it made sense.

The Downsides of a Sole Proprietorship

While sole proprietorship offers simplicity and flexibility, it’s important to understand the risks involved.

The biggest downside is personal liability.

You and your business are legally the same entity as a sole proprietor.

If your business is sued or runs into debt, your assets—such as your house or car—could be at risk.

For example, let’s run a landscaping business as a sole proprietorship, and a customer sues you after an accident involving one of your employees.

If the customer wins the lawsuit, your savings or property could be used to pay damages.

This is one reason some entrepreneurs eventually transition to a more formal structure like an LLC, which provides limited liability protection.

Is a Sole Proprietorship Right for You?

Deciding whether to go with a sole proprietorship depends largely on the size and nature of your business.

A sole proprietorship can be ideal if you’re starting, testing the waters with a side hustle, or planning to run a small, low-risk business.

It allows you to focus on growing your business without getting bogged down by legal paperwork or high startup costs.

But if you anticipate needing outside investors, hiring employees, or dealing with significant financial risk, consider other structures.

In the beginning, though, the sole proprietorship gives you the freedom to get started quickly and adjust as you grow.

How to Set Up a Sole Proprietorship

Setting up a sole proprietorship is incredibly easy.

You’re often ayou’recally considered a sole proprietor once you start conducting business activities.

However, there are a few things you’ll do to ensure you’re doing it legally and efficiently.

First, consider registering a business name.

As a sole proprietorship, you can operate under your name, but if you want to use a business name (also known as a “doing bu” as” or DBA “ame), you’ll need to register it with your local government.

Next, check if you need any licenses or permits to operate your business in your city or state.

This varies depending on the industry you’re in here you’re you’re

Finally, even though it’s not required, opening a separate business bank account is good for organizing your business and personal finances.

Managing Taxes in a Sole Proprietorship

Regarding taxes, a sole proprietorship operates differently than other business entities.

Since you and your business are the same, you report business income and expenses on your tax return.

The IRS requires sole proprietors to file a Schedule C detailing your business’s business and loss.

This allows you to deduct business expenses—such as office supplies, travel, or marketing costs—from your total income, which can lower your overall tax bill.

However, one thing to be aware of is the self-employment tax.

As a sole proprietor, you pay your lawyer and employee portions of Social Security and Medicare taxes.

This can surprise many first-time business owners, so it’s a good idea to plan and save a portion of your income for taxes.

Common Industries for Sole Proprietorships

The sole proprietorship is a popular choice in a variety of industries.

Freelancers, consultants, artists, and small retail businesses often operate as sole proprietorships due to the ease of getting started.

For example, many freelance writers and designers work as sole proprietors because their businesses don’t require a lot of overhead.

They can operate with minimal risk, keeping things simple while focusing on their craft.

On the other hand, small retail shops, like boutiques or cafes, may start as sole proprietorships before transitioning to an LLC or corporation as they grow and take on more responsibilities, like leasing a storefront or hiring staff.

Transitioning from a Sole Proprietorship to Other Business Structures

While the sole proprietorship is a great starting point for many entrepreneurs, it’s common for businesses to cite their structure as they grow.

For instance, if your business starts earning more money or taking on more risk, consider forming an LLC or corporation.

These structures offer limited liability, protecting your assets if your business runs into legal trouble.

This transition isn’t difficult but does require paperwork and possibly additional fees.

That could be the right move if you reach a point where you’re expanding, hiring employees, seeking investors, or transitioning from a sole proprietorship to an LLC or corporation.

Conclusion: The Simplicity and Flexibility of a Sole Proprietorship

Starting a sole proprietorship is one of the easiest and most cost-effective ways to launch a business.

Its simplicity allows you to focus on what really matters—growing your brand and connecting with customers.

While it comes with some risks, especially regarding personal liability, it’s an excellent starting point for entrepreneurs who want to hit the ground running.

Whether you’re a freelancer, a small shyou’reer, or just testing a business idea, the sole proprietorship gives you the flexibility to start small, build your business, and pivot when necessary.

It’s a structure that empowers you to be the boss, make decisions, and create something of your own.

Comments are closed